Case of Non-Payment of Taxes on Especially Large Scale Detected

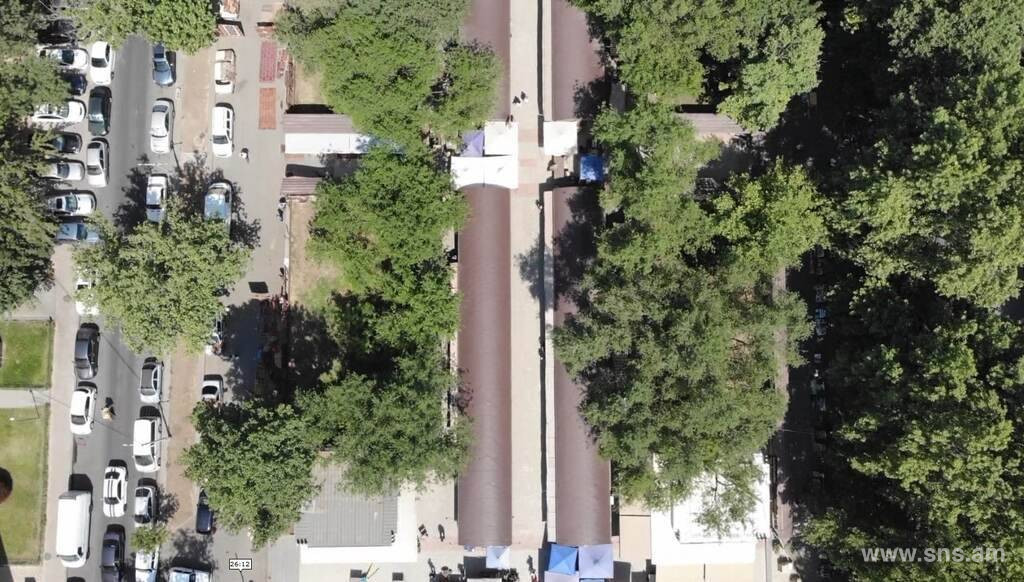

As a result of complex and effective operative-search measures taken by officers of the Yerevan City Department of the RA National Security Service, factual data were obtained that the head and other competent persons of the limited liability company that are tenants of the "Vernissage" fair operating at the address Yerevan, 1/5 Buzand Street, by prior agreement, during 2019-2022, actually subleasing the shopping pavilions available on the territory of the fair to various individuals and legal entities for 1,000 AMD per day per linear meter, some of them were not issued cash register receipts at all, and from the other part of the subtenants, having received a rent in cash in the amount of 1,000 AMD, issued receipts confirming the receipt of rent in the amount of 500 AMD, thus hiding the real turnover of the company and introducing distorted data into the calculations-reports submitted to the RA State Revenue Committee, provided for by legislation, hiding the objects of taxation and other manifestations of fraud, did not pay taxes in especially large amounts - a total of 233,5 million AMD.

On the facts of non-payment of taxes on an especially large scale, a criminal proceeding was initiated in the Investigation Department of the RA NSS on the grounds of Article 290, Part 3, Clause 1 and 2 of the RA Criminal Code, and to resolve the issue of investigative jurisdiction, it was sent to the supervising prosecutor.

The National Security Service urges economic entities to carry out their activities exclusively in the legal field and refrain from committing illegal acts.

Note: The suspect or accused of an alleged crime is considered innocent as long as his guilt is not proven in a manner prescribed by the Code of Criminal Procedure of RA - by the court decision entered into legal force.